Cross Boarder eCommerce and the opportunity for Aotearoa New Zealand

Liberalization of trade in goods and services, new integrated transport networks and information and communication technology (ICT) developments have created unprecedented business opportunities for the trade and transport industry particularly in terms of cross border eCommerce.

The increased level of competition has also resulted in public sector and private sector organizations recognizing the need to move from national and regional business strategies to global business strategies.

In little more than 20 years eCommerce has evolved from movement of small goods from marketplaces and retailers to consumers, to every facet of business enterprise. Achieving cost reductions and maintaining and improving product quality while responding to customer demands.

The acceleration of eCommerce business acceptance, the continued development and improvement of associated digital enablement tools, now reach every facet of business endeavors.

This catalyst of eCommerce change is enabling companies to improve their competitiveness in the global market.

These trends in Cross border, digital, logistics and supply chain management are accelerating as tariff and non-tariff barriers, including customs procedures, are streamlined, and simplified, particularly through bilateral, subregional and multilateral facilitation agreements such as the Southern Link.

The objective of the TAA Southern Link is to “take advantage by increasing trade between China/ Asia and South America and interconnectivity between New Zealand/Australia and Pacific Islands (Oceania). This is likely to deliver benefits for all participants: China/Asian, South American and Oceanian businesses, into a Southern Hemisphere Trade Hub located within Aotearoa New Zealand.

This TAA special Southern Link economic zone will become a magnet for foreign investment.

We foresee the Te Aoutanga Aotearoa Southern Link to be commercially driven by:

- Māori.

- Local Government

- Private/Public Enterprise.

- Supported by Central Government.

This discussion paper overviews the development trend of cross-border eCommerce supply chain in the context of the Southern Link and proposes a strategy of “go to market” based on the advantages of capability, expertise, location, technology, market and partnership.

In doing this we have considered trends in cross border eCommerce business locations, developments in transportation and technology interface systems in order to provide government, policy makers and Stakeholders with guidelines that will assist them in qualifying the opportunity and a roadmap that can be executed in 2023/2024.

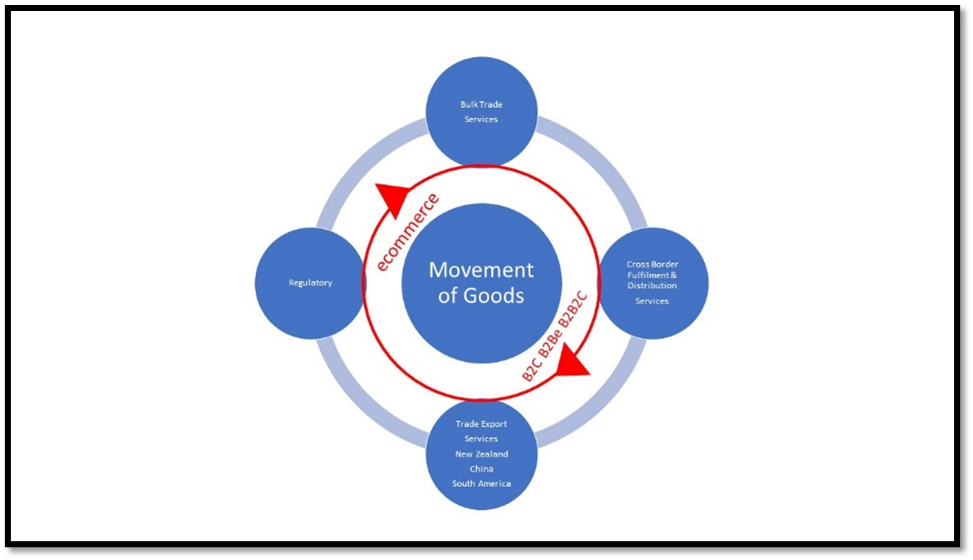

Cross Border eCommerce Movement of Goods workflow

eCommerce Evolution and the importance of Southern Link Te Aoutanga Aotearoa Since the onset of the Covid-19 pandemic, the war in the Ukraine and the disruption of Global supply chains that are buckling under the strain of unprecedented demand and constricted effective logistics capacity.

Consumers across the globe have been heavily reliant on e-commerce to purchase everything from essential goods to holiday gifts.

Combined with widespread stay-at-home orders and concerns since the pandemic. These continued disruptions have accelerated the adoption of e-commerce by consumers and businesses to an unprecedented level.

Digital Council of Aotearoa is an example of a government initiative that has an eCommerce and digital marketplace at its core values and ethos.

That has been accelerated due to the Covid pandemics disruptions on business and people, and where eCommerce became a necessity across every facet of New Zealanders needs.

Forbes (eCommerce trend in 2022) noted, e-commerce will account for 20.4% of global retail sales by the end of 2022, up from only 10% five years ago.

Challenges such as the Covid Pandemic the war on Ukraine and climate change will deepen the reliance on eCommerce across every aspect of business and people’s exigencies.

eCommerce Evolution

eCommerce has evolved from traditional B2C to every aspect of business needs and services (B2Be and B2B2C) impacting every facet of Wholesalers/Retailers/Manufacturers and Consumers.

A TAA Southern Link will mitigate these disruptions by providing a secure base for increased flow of goods and to facilitate the expansion of e-commerce/B2B, current regulations and facilities for processing of goods through biosecurity and customs would need to be examined and upgraded.

Digitally enabled services such as e Invoicing will be the primary platform of all digital monetary trade. eCommerce e Invoicing is a holistic digital ecosystem, services that will be included:

- Sourcing and Procurement.

- Logistics.

- Asset Management.

- Demand and Supply Planning.

- Quote to digital payment.

The idea of New Zealand as a hub for e-commerce in the South Pacific has been proposed and could be extended to provide for a conduit for e-commerce/B2B between China and South America.

“eCommerce is evolving into every person’s lives within every country at an unprecedented rate.” Sustainable eCommerce is the forefront of a digitally enabled trade and will be a catalyst to enable a concerted effort to fully digitalise trade processes.

What is B2B eCommerce?

B2B eCommerce is when one company sells goods or services to another company through an online sales portal.

It’s steadily overtaking more traditional forms of B2B transactions.

Forrester forecasts that U.S. B2B eCommerce will reach $1.8 trillion and account for 17% of all B2B sales in the U.S. by 2020—a compound annual growth rate (CAGR) of 10%.

Forrester believe B2Be will reach US $3 Trillion by 2027. 2.2).

Key Benefits of B2B eCommerce:

Better Reach: Businesses significantly increase their total markets by moving online to reach a global pool of potential customers through web searches.

Higher Efficiency: Forward-thinking businesses migrate their services to the cloud, integrating them for greater efficiency. Inventory tracking, fulfilment, and supply chain management are just three processes that can be streamlined and consolidated through B2B eCommerce.

Easier For Customers: Customers increasingly favor shopping online. Just like B2C, it’s easier to view order histories, track deliveries, access terms and conditions, and browse products.

Increased Order Values: Upsells, cross-sells, recommendations, and promotions are made more accessible and more effective.

Improved Customer Feedback: Potential new customers can read reviews and feedback from existing ones, instilling trust. It’s word-of-mouth at scale.

Lower Overheads: Automation of repetitive, time-sapping tasks reduces the administrative burden on sales and customer service reps. Those on the payroll can spend more time on creative and strategic projects.

Enhanced Analytics: eCommerce analytics provide deeper insights into everything from next year’s sales to the efficacy of marketing spend, aiding decision-making, and informing strategy.

Fewer Costly Errors: The potential for human error is diminished through greater automation and a rule-based back end.

Better Catalogue Management: Adding, removing, and editing products can be done on the fly.

Appealing to Millennials: A growing number of B2B decision-makers are millennials—a group with a strong preference for online transactions.

Ideal for Complex Products: B2B customers benefit from a simple, consumer-like buying experience for even the most complex or engineer-to-order products.

What is B2B2C eCommerce?

B2B2C is a slightly more sophisticated model. It’s also frequently misunderstood. B2B2C isn’t a simple channel partnership where a business wholesales its goods to another company, which in turn sells them to the end-consumer (or another enterprise).

With B2B2C sales, the first business:

(B1) reaches customers through the second business.

(B2) but interacts directly with the customer using its brand.

Unlike a channel partnership, customers are fully aware that they are buying from “B1”, and, crucially, “B1” retains the customers and data generated from every transaction.

For a B2B2C relationship to be successful, there needs to be justification and motivation on all sides.

‘B1’ must be sure that B2B2C will be more profitable or strategically advantageous than going direct-to-consumer, which generally returns a higher margin per transaction.

“B2” must be confident that by acting as a conduit for “B1”, it isn’t damaging sales of its products.

Key Benefits of B2B eCommerce:

How Does a B2B2C Model Benefit B1?

- Large volumes of customers in bulk.

- Economies of scale by selling more units.

- A level of credibility and trust by partnering with an established and respected B2.

- extremely low per-customer acquisition costs.

2) How Does a B2B2C Model Benefit B2?

- A more extensive range of high-quality products.

- Increased sales of related products and services.

- Co-ownership of B1 customers (subject to the B2B2C agreement).

3) How Does a B2B2C Model Benefit Customers?

A higher degree of confidence in their purchase.

Expanding the narrative B2C TO B2C+B2Be and B2B2C Trade” expansion and real value.

Driving the infrastructure that creates a competitive advantage The development of e-commerce hubbing infrastructure could be a key opportunity to turn a comparative advantage into a competitive advantage. In the jargon, a fulfilment centre assists in the development of hyper localisation.

While there are many definitions of hyper localisation, what it requires is an understanding of the customer that reaches across all aspects of retail, including supply chains.

For e-commerce, this requires the development of hubbing/fulfilment center’s that are able to rapidly respond to customer needs, i.e. a customer buys three pairs of jeans, tries them on and sends two pairs back free of charge.

By sending the product 24/48 hours after purchase and then being able to respond in an efficient way to return goods offers an opportunity for New Zealand hubbing facilities that support:

- China(Asia) South American, Australian, and Pacific e-commerce activity.

- By establishing an efficient hub, New Zealand will be in a much stronger position to remain part of the GVC even when technology allows it to be bypassed (i.e. when planes can regularly fly direct from Asia to South America).

The TAA Southern Link Differentiation from (Free Ports/FTZ/Special Economic Zones etc.)

The Southern Link TAA is significantly differentiated from Special Economic Zones in term of e-Commerce cross border connectivity:

- The services will prioritise Cross Border digitally enabled eCommerce (B2Be/B2B2C/B2C,).

- The TAA Southern Link SEZ will have significant focus to promote Cross Border eCommerce trade between member nations.

- Value added will be restricted to Labelling/Packing/Kitting/Sorting/Custom Crating.

- All suppliers’ goods and services accessing the Southern Link must be registered within a TAA Southern Link certification/Compliance framework.